Inside Super 3 – SPS 515 puts the spotlight on strategy execution

Delivering a winning strategy amid heightened regulatory scrutiny

As the end of the year approaches, most executives are turning their minds to the strategy and business planning process for FY2021. Next year, APRA’s new regulations, set to commence on 1 January 2020, are expected to change the way many funds approach this important work.

Over the past 12 months, APRA has released a series of prudential guidelines and requirements (including SPS 515 and SPG 516) with three broad themes that impact super funds’ strategy and planning processes:

- Making member outcomes central to strategy and business planning and expense management processes;

- Ensuring the planned strategy is appropriately implemented; and

- Learning from historical performance and taking corrective actions.

The essence of this regulatory push can be captured in a set of simple questions:

What were your plans?

What did you do?

What did it deliver?

What are you doing next?

To be well set up to meet the SPS 515 requirements, through the strategy and business planning process, funds need to:

- set strategic objectives that reflect the outcomes the fund seeks for members and ensure that decisions to incur significant expenditure support the fund in achieving these strategic objectives

- develop a strategy and business plan to set out the fund’s approach for implementing its strategic initiatives and have proper measures and monitoring processes in place to quickly identify and respond to emerging risks to the plan

- undertake an annual holistic assessment of the fund’s performance (for example, the Business Performance Review and Member Outcomes Assessment) and identify potential changes to aspects of its products, services, or business operations that would improve outcomes for members.

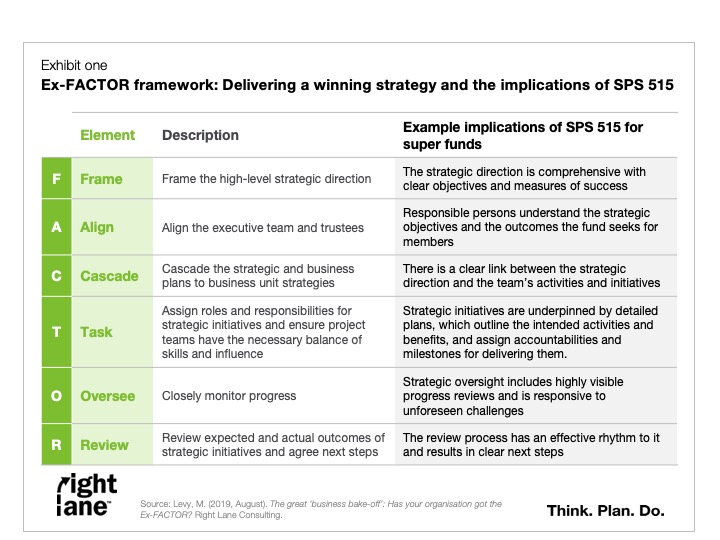

At Right Lane, we mapped the requirements of SPS 515 to our ‘Ex-FACTOR’ framework which highlights the six critical elements for delivering a winning strategy (see exhibit one). Most funds will only require tweaks to their strategy and planning process with respect to framing the strategy and aligning the organisation; the bulk of the impact is likely to be on the fund’s approach to the cascading of the strategy, the assignment of tasks and accountabilities, and the oversight and review processes.

Our team can help you strengthen your strategy and planning process and key strategic documents to better align with best practice, SPS 515 requirements and stakeholder expectations.

Get in touch with Right Lane principal Zoe Pappas to conduct a health check of your current strategic planning process and see how we can help your fund enhance your approach to deliver the best possible outcomes for members.

Zoe Pappas, Principal

P: 03 9428 5336 or zoe@rightlane.com.au

About Zoe Pappas

Zoe is a principal at Right Lane Consulting and has deep experience in industry super. Over the last 10 years, she has led more than 100 projects with 11 industry funds and their service providers, including asset consultants, peak bodies and other collective vehicles. Her work in the sector has included facilitation of board and executive workshops, and leading growth and merger evaluation options, organisation design and strategic planning projects.

Zoe has developed a reputation for clear thinking and communication, including the ability to reframe complex problems to make them easier to understand and solve. Her projects consistently achieve very high client satisfaction and advocacy ratings, in part because she stays very close to clients and their wants and needs. Zoe prides herself on never missing a client signal and always being on top of how directors and senior managers are thinking about her projects.

Right Lane: The purpose-driven consulting firm exclusively serving industry super funds

- We have served industry funds exclusively for almost 20 years: Industry super is one of our core areas of expertise; we have served more than 20 not for profit funds on more than 300 projects, and worked with their service providers in administration, funds management, group insurance, advocacy and banking. We understand deeply the context within which you operate. Since the release of SPS 515, we have supported several industry funds with their integrated approach.

- We have expert knowledge of your operating context: We produce a leading body of work on sector trends to which most large industry funds subscribe; to our knowledge, we have served more profit-for-member funds on topics relating to strategy, outcomes measurement and accountability than any other management consulting firm.

- We unlock value through a commitment to inclusion: Our approach delivers high engagement in the process, and results in strong buy-in to the outcomes.

- We have top-tier consulting credentials: Our consultants all come from top-tier management consulting firms or were trained by them. Since our firm was established, more than 70% of our non-graduate consulting staff have previously worked for McKinsey&Company, BCG, Booz & Co (Strategy &), A.T. Kearney, or LEK.

- We are an ethical consulting firm choosing to only serve profit to member super funds. We are aligned to the values of industry super and stand by our commitment to the network.

Previous ‘Inside Super’ insights are available here:

Inside Super 1 – From strategy to SEAR: regulatory overreach or reasonable expectations?

Inside Super 2 – Direct-to-consumer: remaining relevant in the future of super distribution

We hope the ideas presented here have given you something new to think about. We would love the opportunity to discuss them with you in more detail. Get in touch today.